Top 10 Tips For Buying Your First Home頂端的10個秘訣購買你的第一個首頁

24 Feb 2月 24日

Posted by Travis Wright as張貼特拉維斯賴特作為 Advice 建議 , , Real Estate 房地產 , , Strategic Thinking 戰略思維

Buying your first home is a major milestone and it is important that you acquire as much information as possible before taking this big leap.購買您的第一家是一個重大的里程碑,這是非常重要的您獲得盡可能多的信息,然後才採取這個大的飛躍。 While my clients generally ask me questions about improving their credit and getting a lower interest rate, this outline covers the entire process to, hopefully, make it an enjoyable而我的客戶一般問我問題,改善他們的信用和取得較低的利息,這個大綱涵蓋了整個過程,希望使一個愉快的  and stress-free experience.和應力-免費的經驗。

and stress-free experience.和應力-免費的經驗。

1. 1 。 Be Prepared & Knowledgeable - Sign a contract with a buyer’s agent who is familiar with the area in which you want to buy a home; independently search your local MLS and realtor.com; and find a mortgage broker who inspires confidence and has a solid reputation.準備與知識-簽署合同,與買方的代理人,誰是熟悉該在這方面,您想要買一個家;獨立搜索您當地的職業足球和r ealtor.com;找到一種按揭經紀誰激發信心和有良好的聲譽。

2. 2 。 Getting Pre-Approved - Before you actually visit any homes, research and select a lender such as Quicken Loans, AmeriQuest, or Wells Fargo.獲得預先核准的-之前,你實際上訪問任何的家園,研究和選擇一個貸款人,如加快貸款, a meriquest,或水井,法戈。 After you have chosen the one that is right for you, get pre-approved to determine your price range and show potential sellers that you are a serious buyer, which can also increase your bargaining power when you find your dream home.之後,您選擇的是一個更適合你,獲得預先批准,以確定您的價格範圍和顯示潛在的賣家,你是一個嚴重的買方,這也可以提高您的議價能力,當您找到您的夢想家園。

3. 3 。 Understand Your Loan - There are various types of mortgages, 30 year fixed, 15 years fixed, 5/1 ARM, 3/1 ARM, etc., that you need to be familiar with before you can sign on the dotted line.了解您的貸款-有各類抵押貸款, 3 0年期固定, 1 5年固定, 5 / 1臂, 3 / 1手臂等,您需要熟悉,才可以簽署關於虛線。 While a 15 or 30 year fixed mortgage with 20% to 25% down is the best option for most first time buyers, I occasionally advise some people to do an 80 / 10 / 10.而15年或30年期固定抵押貸款與20 %至25 %下降是最好的選擇對於大多數第一次買家,我偶爾會提醒,有些人做了80 / 10 / 10 。 20% down may seem excessive and unexpected, but paying 20% down or more towards the note allows you to avoid the PMI (Private Mortgage Insurance) cost that can be expensive and useless. 20 %下降可能似乎過多和意想不到的,但付出的20 %下降或以上,對允許您注意,以避免採購經理人指數(私人按揭保險)的成本可能很昂貴和無用的。

As a general rule, avoid exotic loans so you don’t need to worry about fluctuating costs from month to month and changing interest rates.作為一般規則,避免外來貸款,因此您不必擔心成本波動,每月和不斷變化的利率。 If interest rates plummet from what you signed up for, in many instances you can refinance.如果利率大跌,從你簽署了為,在許多情況您可以再融資。

4. 4 。 Preparing Your Credit - While everyone knows that their credit score will be an important element in determining their mortgage payments, most do not follow a few simple tips for improving their score in the months leading up to the closing.準備您的信用卡-雖然大家都知道,他們的信用評分會的一個重要組成部分,在決定他們的供樓,最不遵守幾個簡單的提示,為改善他們的評分在未來幾個月,直至關閉。 First, make sure you keep the balance on your credit cards under a quarter of the total line of credit.首先,確保您保持平衡,對您的信用卡下季的總路線的信用。 Also, avoid large purchases or transfers that might appear out of the ordinary.此外,避免大量購買或轉讓中可能出現的失控一般。 And finally, pay off debts such as student loans that may be keeping your score down.最後,還清債務,如助學貸款可能使您的評分下降。

5. 5 。 Gather Data - Your lender will generally require 2 years of tax returns, a year of bank statements, W-2’s and 1099’s from the past 2 years, and a list of your current debts such as car and student loans.收集數據-您的貸款將一般需要2年的報稅表,一年的銀行對賬單,瓦特- 2和1 099年的從過去的二年,名單您目前的債務,如汽車和助學貸款。 By having these prepared before they ask for them, you can save yourself a lot of time and avoid unnecessary stress.因這些準備之前,他們要求對他們來說,您可以節省大量的時間和避免不必要的壓力。

6. 6 。 Learn The Local Market - Many realtors will offer you “comps” on recently sold homes in your area of interest.了解本地市場-許多房地產經紀人將為您提供“ c omps” ,最近出售的家園在您感興趣的領域。 Be sure to look over these carefully, particularly the asking price of the homes, what they sold for, and the price per square foot.一定要看看這些小心,尤其是要價的家園,他們出售,價格每平方英尺。 With this information in hand, you can submit a more competitive first offer and come across as a serious buyer.與這方面的資料在手,您可以提交一個更具競爭力的第一提供和碰到作為一項嚴肅的買家。

7. 7 。 Compare Lenders - After your offer is accepted, I strongly suggest using the quick, easy, and free services of LendingTree to compare interest rates for your mortgage.比較放款人-之後,您的提供,接受,我強烈建議使用快速,簡單,和免費服務的l endingtree比較利息為您的按揭貸款。 While you may have found already found a trusted lender for your pre-approval, there is no guarantee that he will give you the best rate.雖然您可能已經發現,已經找到了值得信賴的貸款為您的預先核准,我們不能保證說,他會給你最好的利率。 One thing you can do, however, is take the best rate you receive from LendingTree and discuss this rate with your local bank and trusted lender.一件事,你可以做,但是,是採取最優惠費率,您收到的來自lendingtree和討論,這個比率與您當地的銀行和貸款人的信任。 With this bargaining power, you can determine who really wants your business, get the best possible interest rate, and save the most money in the long run.與此討價還價的能力,您可以決定誰真的希望您的業務,獲得最佳的可能利息,並保存最多錢在長遠來說。

8. 8 。 Avoid Pricey Closing Costs - As you narrow down your list of mortgage lenders and receive some great quotes on interest rates, ask for a good faith estimate so you can estimate your closing costs.避免昂貴的閉幕成本-由於您縮小您的名單,按揭貸款和接收一些偉大的行情就利息,要求有一個良好的信心,估計使您可以估算您的閉幕成本。 Although many individuals overlook these one-time, up-front costs, they can add up quickly and are an important element in selecting a lender who is right for you.雖然許多個人忽視這些一時間,預付成本,他們最多可新增迅速的一項重要內容,在選擇貸款人誰是最適合你。

9. 9 。 Get an Inspection - When your offer is accepted and it seems that the process is almost over, do not get too attached and believe that the home is already yours.獲得一檢查-當您的提供,接受和看來,這個過程是幾乎超過,不要太重視,並相信這家已經是你的。 Although it can be a major stumbling block in the negotiations, you absolutely need to have a qualified inspector look for termites, pests, foundation problems, and numerous other things that cannot be seen when you stroll through a home.雖然它可以是一個主要的絆腳石在談判中,你絕對需要有一個合格的督察尋找白蟻,害蟲,基礎的問題,和許多其他的事情都無法看到,當您漫步在通過一個家。 Sometimes the inspector will only find minor problems, but other times there are extremely expensive issues that may make your purchase impossible.有時督察將只能找到小問題,但其他時候,有極為昂貴的問題,可能會使您的購買是不可能的。 Under any circumstances, you cannot skip this step.在任何情況下,您不能跳過此步驟。

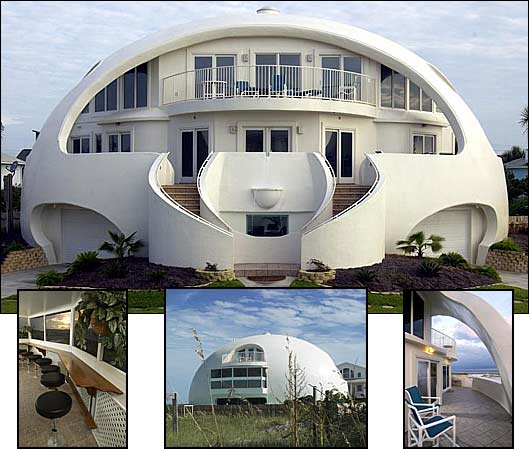

10. 10 。 RELAX - It can be expected that this major milestone is going to be somewhat stressful considering the major investment and lifestyle change you are making.放寬-可以預料,這項重大的里程碑,是要有點壓力,考慮的重大投資和生活方式的改變,你是決策。 However, it should also be fun so take pictures of the homes you like, both inside and outside, and write notes about each place you see.不過,它也應同樂,所以拍攝的家園你喜歡,內外,並寫筆記約每一個地方,你看到的。 At the end of the day, if you follow the above steps and listen to your heart, you are bound to be one happy homeowner.在這一天結束,如果您遵循上述步驟,並聽取你的心,您一定會有一個快樂的房主。

Good luck and happy house hunting!好運氣和幸福之家狩獵!

Don’t forget to subscribe to the 不要忘記,要訂閱到 Cultivate Greatness | Life Hacks RSS Feed 培育的偉大|生活駭客RSS饋送 for more great coverage and updates! 為更偉大的覆蓋面和更新!Sponsored Link:贊助商鏈接: Lucrative Personal Development Home Business 利潤豐厚的個人主頁業務發展

Sponsored Link:贊助商鏈接: Contact us to add yours here! 聯繫我們添加你在這裡!

College and University Online Search :學院和大學的在線搜索:

Subscribe (訂閱( RSS的RSS | Email電子郵件 ) )

contact聯繫方式

browse CG瀏覽的CG

- View查看 Recent Posts最近的帖子

- View查看 Recent Comments最近的評論

- View查看 Most Commented最多評論

Categories 類別

- Achievement成就

- Advice建議

- Assertiveness自信

- Attitude態度

- Author Interviews作者訪談

- Blog Carnival博客嘉年華

- Book Reviews書評

- Brain Fitness腦健身

- Brainstorming獻計獻策

- Breathing呼吸

- Business Development業務發展

- Career & Work職業與工作

- CEO Training首席執行官培訓

- Character性格

- Charity慈善

- Concentration & Focus濃度及重點

- Confidence信心

- Consciousness意識

- Continuing Education繼續教育

- Courage & Fear勇氣與恐懼

- Creativity創造力

- Credit Repair信用修復

- Cultivate Greatness培育的偉大

- Decision Making決策

- Energy能源

- Entrepreneurship創業

- Esoteric Knowledge深奧的知識

- Family家庭

- Fitness & Health健身與健康

- Focus重點

- Friendship友誼

- General一般

- Goals & Goal Setting目標與目標設定

- Gratitude感謝

- Green Living綠色生活

- GTD幾何繞射理論

- Habits習慣

- Healing癒合

- Heroes英雄

- Highly Recommended強烈推薦

- Imagination想像力

- Innovation創新

- Inspiration啟示

- Integrity完整性

- Interpersonal Communication人際溝通

- Intuition直覺

- Law of Attraction吸引定律

- Leadership Training領導才能訓練

- Life Hacks生活竅門

- Love & Relationships愛&關係

- Manifesting & Intention體現了與意圖

- Mantras & Affirmations曼陀拉&誓詞

- Mastery通達

- Meditation & Relaxation冥想&放寬

- Mental Physical & Spiritual Fitness精神與身體的精神健身

- Mentoring指導

- Morning Ritual今天上午儀式

- Motivation動機

- Napoleon Hill拿破崙希爾

- Optimism樂觀

- Organization組織

- Parenting親職教育

- Peak Performance高峰期的表現

- People Skills人的技能

- Personal Development個人發展

- Personal Finance個人理財

- Personal Growth個人成長

- Physical Fitness體能

- Podcasts播客

- Positive Thinking正面思考

- Productivity生產力

- Prosperity Consciousness繁榮意識

- Psychology心理學

- Public Speaking在公眾場合演講

- Quantum Physics量子物理學

- Real Estate房地產

- Self-Discipline廉潔自律

- Spirituality & Enlightenment靈性與啟示

- Strategic Thinking戰略思維

- Stress Reduction強調減少

- Subconscious Mind潛意識記

- Success成功

- Time Management時間管理

- Visualization Exercise可視化演習

- Wealth & Money財富與金錢

- Weight Loss體重減輕

- Wellness健康

- Yoga瑜珈

Archives檔案

- May 2008 2008年5月

- April 2008 2008年4月

- March 2008 2008年3月

- February 2008 2008年2月

- January 2008 2008年1月

- December 2007 2007年12月

- November 2007 2007年11月

- October 2007 2007年10月

- September 2007 2007年9月

- August 2007 2007年8月

- July 2007 2007年7月

- June 2007 2007年6月

- May 2007 2007年5月

- April 2007 2007年4月

- March 2007 2007年3月

- February 2007 2007年2月

- January 2007 2007年1月

- December 2006 2006年12月

- November 2006 2006年11月

- October 2006 2006年10月

- September 2006 2006年9月

- August 2006 2006年8月

- July 2006 2006年7月

- June 2006 2006年6月

- May 2006 2006年5月

- April 2006 2006年4月

- March 2006 2006年3月

- February 2006 2006年2月

- January 2006 2006年1月

- December 2005 2005年12月

Conversationalists conversationalists

- Charlie查理。

- Howie侯偉

- Etavitom etavitom

- Pamela尤德夫

- Josh Bickford喬什比克福德

- Dave戴夫

- Patrick ALlmond帕特里克allmond

- Saymorre saymorre

- Steve Olson史蒂夫奧爾森

- Windows Shopper在Windows購物

- ken Triat縣triat

- Alex Shalman徐家沙勒幔

- SimoneM simonem

- Craig Harper克雷格哈珀

- Ashish Mohta阿什mohta

Links 鏈接

- Steve Olson史蒂夫奧爾森

- HunaTrainer.com hunatrainer.com

- Life Optimizer優化生活

- WiseBread wisebread

- SalesMotivation.net salesmotivation.net

- Craig Harper - Motivational Speaker克雷格哈珀-動機議長

- Online MBA Schools在線的MBA學校

- Fix College Student Debt修正大學生的債務

- MediaThinkLab mediathinklab

- Adiqus LLC adiqus LLC公司

- 8 Day Weekend 8天週末

- Wealthy as You Want富裕作為您想要

Meta中繼

- Register註冊

- Log in在日誌

- Valid XHTML有效的XHTML

- XFN xfn

- WordPress在WordPress

Recent Entries最近條目

- Do You Realize What your Words Can Do?你知道你的說話,可以做什麼呢?

- Find Something To Give a Damn About找到的東西給予一個可惡約

- What is the Value of One Hour?的價值是什麼一小時?

- Quiet Strength, Quiet Leader, Quiet Winner安靜的力量,安靜的領導人,安靜的贏家

- What a Great Wife - Surprised me with Big 35th Birthday Party什麼偉大的妻子-奇怪,我與大第三十五生日派對

- Make a Binding Agreement with Yourself for the Life of Your Dreams作出有約束力的協議,與自己的生命,你的夢想

- 100 Simple Ways to Change Your Life for the Better 100簡單的方式改變你的生活,以便更有效地

- 3 Steps to Better Public Speaking 3個步驟,以更好地在公眾場合演講

- Top 10 Healthy Foods We Never Eat十大健康食品,我們從來沒有吃

- Cultivate Greatness - New Google PageRank of 5.培育的偉大-新的G oogle的P ageRank5 。

- 14 Habits That Make You Fat 14習慣,使你脂肪

- Skip the Tuition: 100 Free Podcasts from the Best Colleges in the World跳過學費: 100個免費的播客從最好的大學在世界上

- The Challenge of Change挑戰變化

- 7 Easy Ways to Make More Money, Working Less 7簡便的方法來賺更多的錢,少工作

- Secret Strategies Of The Gurus: Guru 1 - Bill Gates As A Small Business Entrepreneur秘密戰略的大師:大師1 -比爾蓋茨作為小型企業的企業家

Recent Comments最近的評論

- mahesh:馬赫什: i want to know how to我想知道如何

- Ron Belluso:羅恩belluso : I agree with many of the我同意很多的

- Organize IT Recap: Investing, Writing Binding Contracts - Practical advice on personal development, productivity and GTD:組織,它回顧一下:投資,寫作有約束力的合同-實用建議對個人發展,生產力和幾何繞射理論: [...] Cultivate Greatness suggests writing a [ … … ]培育的偉大建議寫

- Barbara Ling:芭芭拉玲: What a great idea!有什麼好主意! Generally一般

- Jim Abbondante:吉姆abbondante : I think one of his strategies我認為他的一個策略

- Derek:康士: Some people have the willpower but有些人有意志,但

- John Jefferson:約翰傑佛遜: Great list some i have偉大的中列出了一些我

- Suchitt Dave, Advocate, Supreme Court, India: suchitt戴夫,辯護律師,最高法院,印度: I think this was a good我覺得這是一個很好的

- Matt:馬特: It's a unique idea, but would它的一個獨特的想法,但是會

- Mark T. Rafter:馬克湯匙,拉夫特: Great breakdown of the mental aspects偉大的細目心理方面

Most Commented最多評論

- What is the Perfect Morning Ritual?什麼是完美的儀式,今天上午呢? Let's Define Your Morning Ritual.讓我們定義您今天上午的儀式。 (29) ( 29 )

- Jerry Seinfeld's Productivity Secret傑里塞恩菲爾德的生產力的秘密 (15) ( 15 )

- The Three Things That You Must Do To Effectively Use The Law Of Attraction.該三件事,你必須做有效利用的法律的吸引力。 (13) ( 13 )

- 18 Tricks to Teach Your Body 18歲的技巧,教導你的身體 (13) ( 13 )

- A Money Trick...金錢的把戲... Literally, an Origami Folding Money Trick從字面上看, 1摺紙折疊金錢的把戲 (11) ( 11 )

- CG Podcast #002 - Napoleon Hill's Law of Success Podcast Series #01 - The Master Mind的CG播客# 002 -拿破崙希爾的法成功的播客系列# 0 1-主記 (10) ( 10 )

- Choose To Be Around People Who Make You Think選擇左右的人誰使你覺得 (10) ( 10 )

- 6 Dangerous Reasons People Do Not Set Goals and Never Succeed 6危險的原因,人不設定目標和永遠都不會得逞 (10) ( 10 )

- CG Podcast #003 - Napoleon Hill’s Law of Success Podcast Series #02/16 - A Definite Chief Aim的CG播客# 003 -拿破崙希爾的法成功的播客系列# 2月1 6日-一個明確的,行政的目的 (9) ( 9 )

- The Secret to the Law of Attraction is Simple - Gratitude秘密法的吸引力,很簡單-感謝 (9) ( 9 )

RSS feed for comments on this post RSS饋送的評論對這個職位 · TrackBack URI Trackback跟踪的URI

Leave a reply離開的答复